4

Acquisitions

8

Locations

140

Employees

€35M

Turnover

WHAT WE DO

We specialise in acquisitions of successful family businesses. We continue to build on what you have built and are fully committed to long-term continuity. Our team of experts ensures a correct, transparent and discrete acquisition.

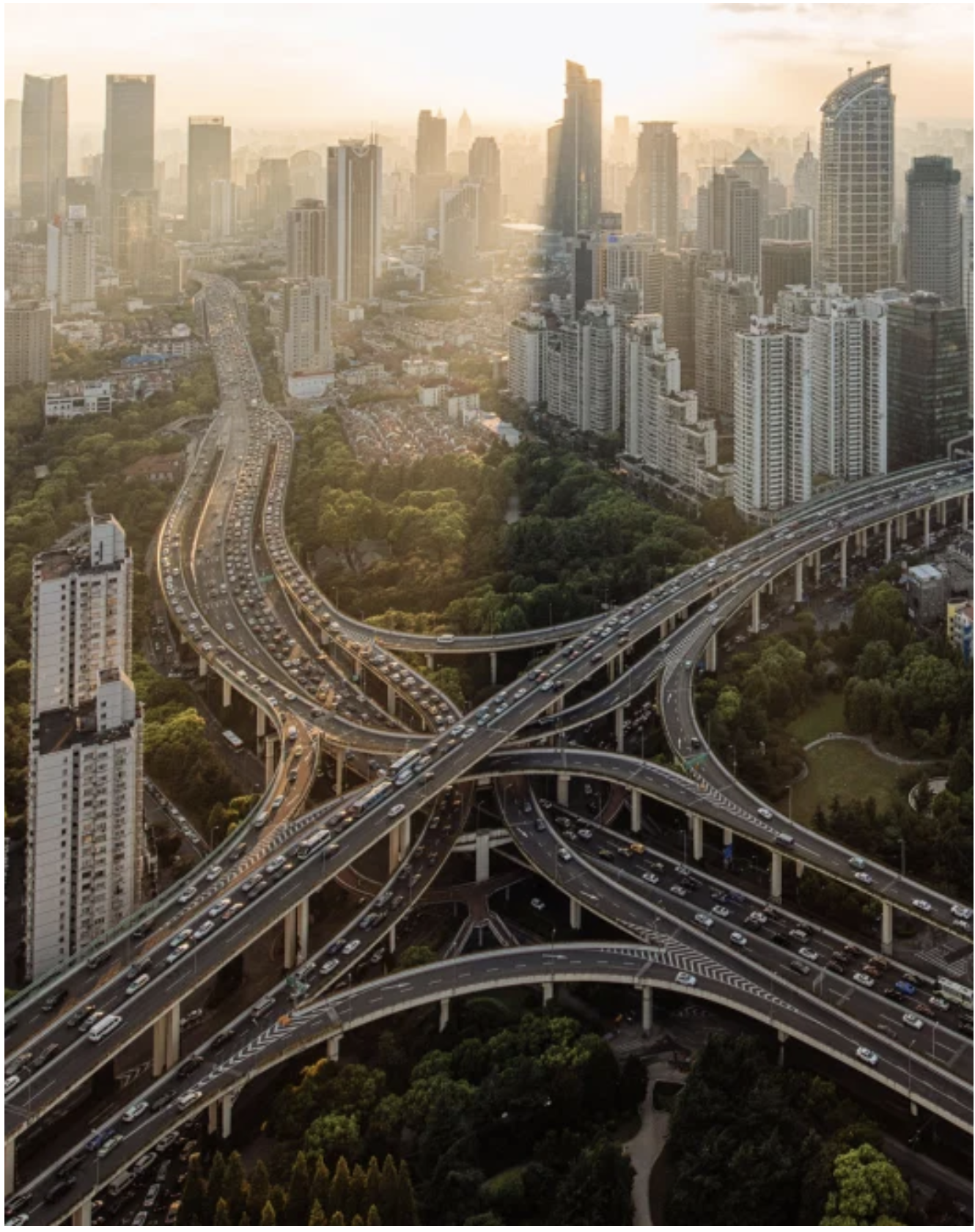

Focus

With AIM Family Business we are building a portfolio of healthy (Belgian) SMEs, active in the B2B segment. We always invest and undertake in tandem with an ambitious and talented manager and aim for both 100% acquisitions as well as majority participations. We always do this with our own resources, for the long term and without an exit strategy.

We are looking for acquisitions in tandem with ambitious managers, often in a context where the selling shareholder has no family succession, or majority shareholdings on the side of the existing management.

Combining forces

Together we have a balanced mix of operational and financial-strategic skills. In tandem we determine the appropriate strategic direction and take the right steps in our growth path.

Long term

AIM Family Business always focuses on long-term value creation, given that we invest with our own patient capital. We build companies at our own pace on a standalone basis, while respecting the company's identity. the corporate identity.

Our strategies

aim.group invests and undertakes together with an external manager, who takes over the operational management of the company after the take-over and also participates as a shareholder ('Management Buy-in' or 'MBI').

We have built up a successful track-record in MBI transactions, always acquiring companies for 100%. In this way, we offer a solution for ambitious managers who wish to do business and for selling shareholders who wish to sell due to a lack of internal or family succession. who wish to sell due to a lack of internal or family succession.

In a Management Buy-Out ('MBO') aim.group invests and undertakes in tandem with an internal ('sitting') manager. The internal manager acts as operational leader and becomes a shareholder, supported by aim.group in order to realize the next growth phase.

We offer a solution for ambitious managers who wish to become shareholders in their company. This type of transaction often occurs when the selling shareholder does not have a family succession and wants to give the opportunity to a manager within the company to take over the shares.

A variant on this is the Owner Buy-Out ('OBO') where one of the shareholders wants to buy out the other(s). In this transaction aim.group acts as a partner of the buying shareholder and offers a solution on both sides of the spectrum. The remaining shareholder can realize the growth plans, while the exiting shareholder secures a part of the capital.

What can you expect from us

Transparency

An acquisition is complicated. We will ensure clarity and transparency and will give you an accurate estimate on how much your business is worth.

We build on your story

In order to remain successful in the long term, we believe it is key to continue to build on your story.

Employment guarantee, also in the long term

At aim.group we strongly believe in your and our people. After all, motivated people are essential to be successful in the long run.

Close involvement

in overdracht

After the acquisition itself, you remain closely involved in the effective transfer. Your knowledge and experience is invaluable here.

The right manager

Finding the right manager is essential for the survival of your business. We use our experience and network to find the right manager and involve him/her in the acquisition process.

"In our entrepreneurial corporate culture we believe, and therefore invest, heavily in the human capital of our portfolio companies. Mutual trust and respect, no-nonsense straight-talk and drive to excellence are at our central."

Dieter Aelvoet

Founder & Owner

Looking for a acquirer? Do you recognize our values and what drives us? Do you see your company standing alongside our current portfolio companies?

Contact us Feel free to make an acquaintance, always free of obligations and in all discretion.

Testimonials from our entrepreneurs

Stijn

Shareholder & CEO

Vandapower

Thanks to aim.group I can fully focus on what matters: doing business and growing Vandapower.

Niels

Shareholder & CEO

DD Engineering

aim.group gives me both the freedom and the necessary support to make DD Engineering a real success.

Tim

Shareholder & CEO

ESTEE Coating Solutions

The speed of execution is very strong at aim.group. So are the ideas to grow ESTEE Coating Solutions. When decisions are taken we really go for it.

Why they choose aim.group

Successful and transparent acquisition

An acquisition is complex. Together we will go through all the steps, at your pace, and involve you in every decision. We provide clarity and transparency and have the expertise and experience to bring the acquisition to a successful conclusion. successful conclusion.

Extensive support

Our domain experts are continuously available to your company and provide a supportive and expert sounding board.

Sincere partnership

aim.group stands for a sincere and healthy partnership where everyone has equal interests. Trust and respect are central. Good agreements make good friends.

Full impact on success, make the difference

Full impact on success, you make the difference. We give you the freedom to run your business and assist you in a supportive role.

Long term growth

Our vision is unambiguous: well-considered growth in the long term. Together we expand the company with the necessary investments in both people and activity and give it the time to further develop.

Ready to take the leap? Ambition to take on an entrepreneurial role and invest with aim.group?

Contact us Feel free to make an acquaintance, always free of obligations and in all discretion.